Our Experience

Why Companies Hire Us

Your business is scaling — but your financial systems aren’t keeping up.

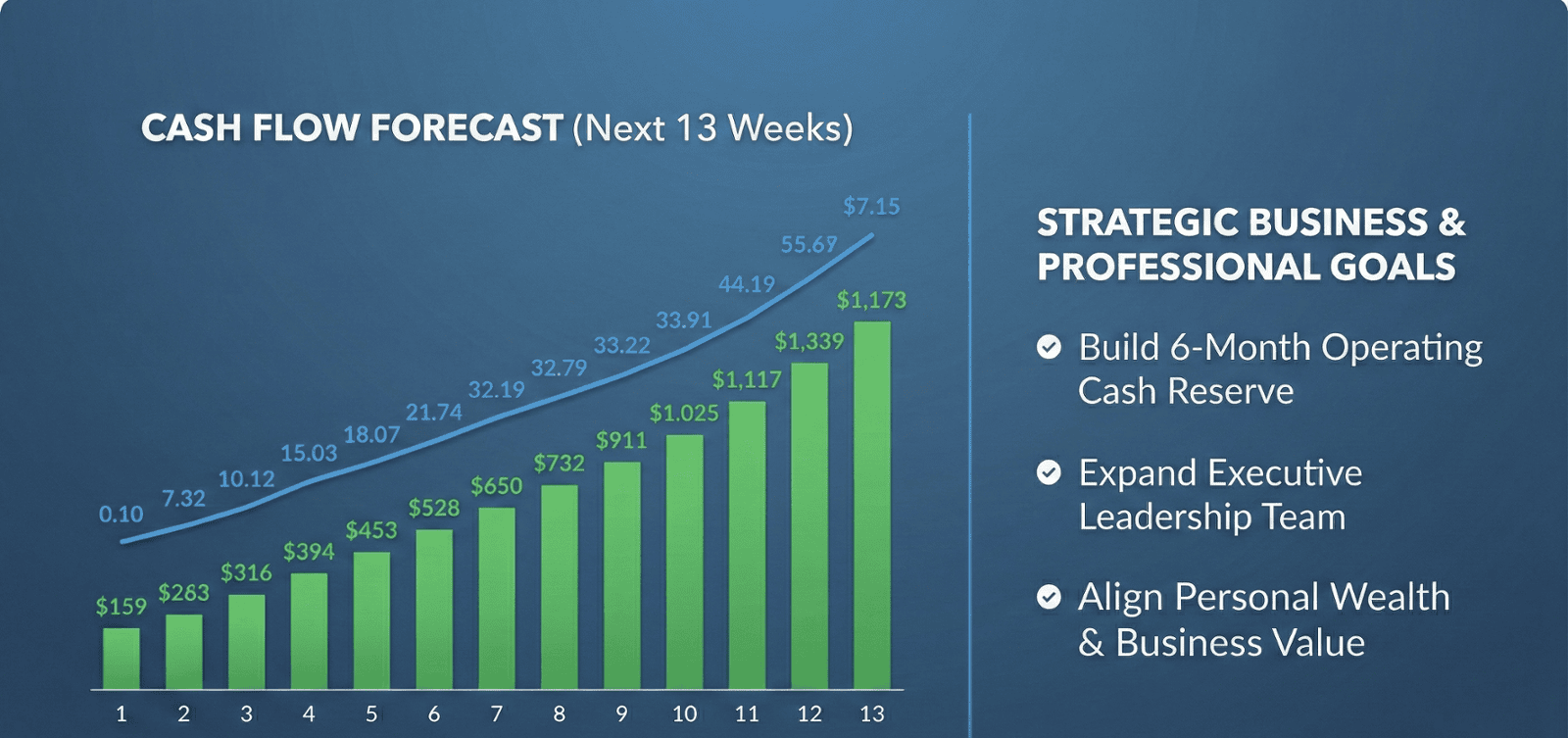

Monthly Executive-level financial leadership for growing Florida-based professional service firms. This partnership gives you a forward-looking financial system, advanced planning & analysis, and strategic advisory that connects your business goals with your personal goals.

We operate side-by-side with your leadership team to sharpen profitability, stabilize cash flow, and guide confident decision-making across your entire business. We make sure you don’t just set goals — we hold you accountable to reaching them.

Required for all new Strategic fCFO Partner engagements.

This is the comprehensive system we build before strategic CFO work can begin. It ensures your financial foundation, reporting structure, and forecasting inputs are accurate, reliable, and engineered for decision-making.

We review your Chart of Accounts, analyze historical data integrity, map operational and financial drivers, and install your controller-grade financial system.

This phase ensures your financial environment is accurate, stable, and fully prepared for strategic forecasting and advisory, producing the reliable insights required for confident decision-making.

A one-time project to analyze and permanently improve how cash moves through your business, from proposal to payment.

We review your billing cycle, vendor terms, collections process, and payment rhythms to build a customized cash management system that accelerates cash in, stabilizes cash out, and strengthens your working capital.

We also create and deliver a clear A/R and A/P Playbook and train your team on proven best practices to maintain long-term cash stability.

Who we are

How We Work With You

A Financial Partnership Tailored to Your Business

Every business operates differently. That’s why our fractional CFO engagements are custom-built after a collaborative scope process.

We take the time to understand:

- Your revenue model and pricing strategy

- Your delivery capacity and cost structure

- Your leadership goals and exit timeline

- The level of financial support your team truly needs

Only then do we define the right level of CFO involvement — and only then do we discuss investment.

About Us

What You Can Expect

After our Scope Call, you’ll receive:

- A defined scope of work

- The business outcomes we’ll help you achieve

- The cadence of CFO involvement

- A recommended investment based on the value we will unlock

This ensures the investment is proportional to your financial complexity, your goals, and the strategic lift required. For most clients, our fees represent a small fraction of what a full-time CFO would cost and a small percentage of annual revenue, while providing executive-level leadership and a clear decision-making system.

Our Process:

Our Niche:

Who We Serve

We specialize in Florida-based B2B Professional Service companies, including but not limited to:

- Marketing & creative agencies

- MSPs & IT service providers

- Law firms on retainer

- Consulting firms

- Professional services groups

Excited to welcome you soon!

Are You An Ideal Client?

Are you operating at $3M–$15M revenue, with between 10–50 employees, and leaders who want financial clarity, profitable growth, and strategic guidance?

Schedule Your Discovery Call: